Mergers and acquisitions, the effect of the global pandemic on M&A in North America and in Europe

The coronavirus crisis permeated every aspect of society, from politics to economics, from culture to personal relationships. In the financial sector, one of the most important consequences has been the collapse of M&A activities in Europe and the United States.

The world of mergers and acquisitions has always survived and recovered from previous economic crises, and as happened in the past, uncertainties in the markets have already contributed to delaying or interrupting acquisition plans.

This time, however, the situation is more complicated: the impact of the pandemic has not only been on the financial system in general, on the judgement of sellers and the willingness of buyers to close short-term deals. Other factors have influenced mergers and acquisitions. These include contractual terms, new due diligence issues that have arisen, the availability, pricing and time needed to obtain the necessary regulatory and other third-party authorisations for transactions.

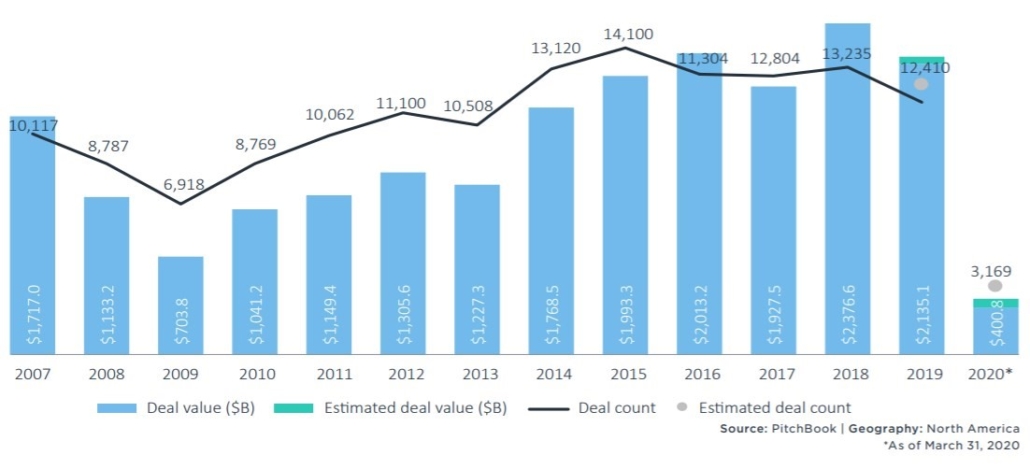

The American crisis in the merger market

Global mergers and acquisitions have already plummeted following the coronavirus crisis and by the end of March 2020 had almost stopped completely. Mergers and acquisitions levels in the U.S. declined by more than 50% in the first quarter dropping to $ 253 billion compared to 2019, but most of those transactions were concluded or closed early in the quarter before the crisis spread all over the world.

Furthermore, the strategies of companies that are typically on the acquisition side have been redirected towards protecting their assets by abandoning longer-term objectives such as investments in growth through acquisitions. Similarly, private equity institutions have focused their efforts on strengthening or saving the companies in their portfolio, at the expense of newly traded assets.

An American law against Mergers & Acquisitions?

A proposed act was introduced in the United States Congress known as the Pandemic Anti-Monopoly Act, a law aimed at freezing the takeover of companies with over $ 100 million in revenue and financial institutions with over $ 100 million in market capitalisation for the duration of the crisis.

The proposed act is similar to the one introduced by the Republican Congressman David Cicilline, Chairman of the Subcommittee on Antitrust, Commercial and Administrative Law. The aim of the two measures is to block speculative transactions at a time when the ratings of many companies are dropping due to the economic repercussions of the health crisis.

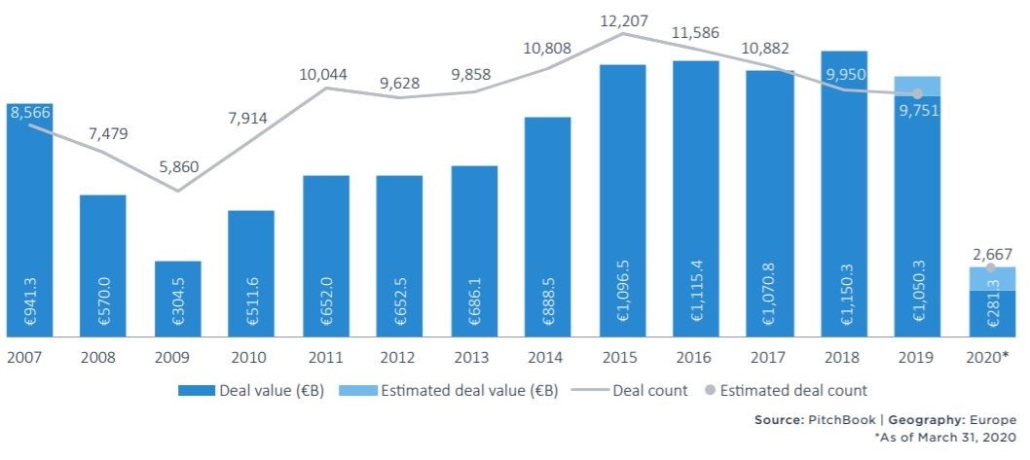

The European market is also slowing down

The effects of the pandemic have also been felt in M&A in Europe where the sector appeared to be in a good state until the emergence of the crisis. In the first quarter of the year, 2,677 transactions were closed for a value of € 281.3 billion. This is progress, respectively 15.6% and 11% compared to the same period last year.

The spread of coronavirus in Europe has called prospects into question, bringing M&A transactions to practically zero. According to the statements of some advisors in the sector, about 90% of payment instructions have been put on hold.

European companies and the risk of foreign influences

To protect each country’s industrial heritage, EU countries are considering necessary countermeasures, including controls on foreign investment, strategic strengthening of holdings and nationalisation. The European Commission also urged member states to “use all options to protect critical European companies from foreign takeovers or influence that could undermine our security and public order”.

“As in any crisis, our industrial and corporate assets are under stress. The resilience of our industries, their ability to continue to meet the needs of EU citizens and to preserve strategic resources and technologies is fundamental”, stated a spokesperson for the European Commission.

The EU is concerned that foreign investors may attempt to acquire European companies “with the goal of taking control of key technologies, infrastructures or knowledge”. The EU is also concerned about strategic and delicate issues like security.

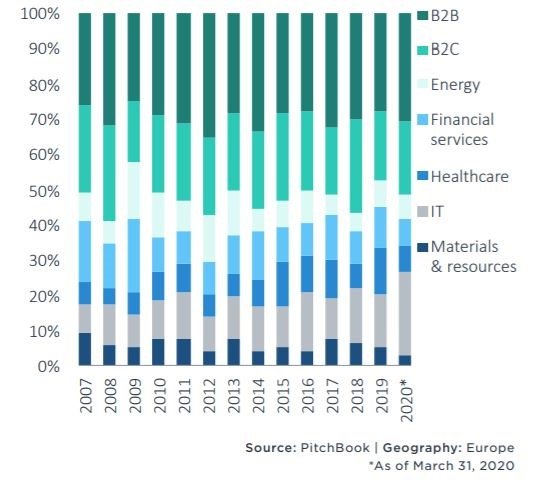

Healthcare remains stable and IT is growing

Healthcare has seen an increase in activity compared to the first quarter of last year, in line with what has been happening in recent years. Furthermore, the global pandemic is demonstrating how the sector can be a strategic asset against the recession so it is possible that M&A transactions in this context will continue to grow.

On the other hand, one sector that is experiencing a growth phase right now is Information Technology. IT companies specialising in service delivery and cybersecurity seem to be better able to defend themselves against the risks of a recession. On the one hand, citizens have reached a level of using IT infrastructures that has never been seen before, on the other, companies have an ever growing need to protect themselves from new technological risks and to be able to manage their business safely.

Evidence in the professional translation services market

During the entire time we were in lockdown, Intrawelt continued to work non-stop. In compliance with the measures in place to safeguard everyone’s health, the translation agency continued to manage a significant number of translation projects thanks to remote working.

During these difficult months we translated several financial statements and financial reports, we have worked on remote interpreting projects for business negotiations but we have seen, especially in recent weeks, a drop in the demand for the translation of financial documentation related to the closing of merger and acquisition agreements, in line with our analysis so far. We understand and share the concerns regarding the risk of weakening national industrial systems for the benefit of external speculation, our hope is that effective protection measures will be taken as soon as possible, for the good of the whole system and of the many companies involved, some of which we have the privilege of working with constantly.

References and further reading:

COVID-19’s Impact on Global M&A (Boston Consulting Group)

Coronavirus effects on private markets (Pitchbook)

The Impact Of The Coronavirus Crisis On Mergers And Acquisitions (Forbes)

Elizabeth Warren, Alexandria Ocasio-Cortez want mergers halted due to COVID-19 (Pitchbook)

EU helps protect weak firms from foreign takeovers (BBC News)

Vestager urges stakebuilding to block Chinese takeovers (FT)

Coronavirus: EU fears a rise in hostile takeovers (Deutsche Welle)